“The property price is rising faster than rocket?!”

So what exactly causes property prices in Singapore to rise and fall? And you will be surprised (or not so surprised), it is determined solely by the Demand and Supply of Singapore Properties!

In this two part analysis, we will examine the rise and fall of property prices in Singapore using Demand and Supply analysis.

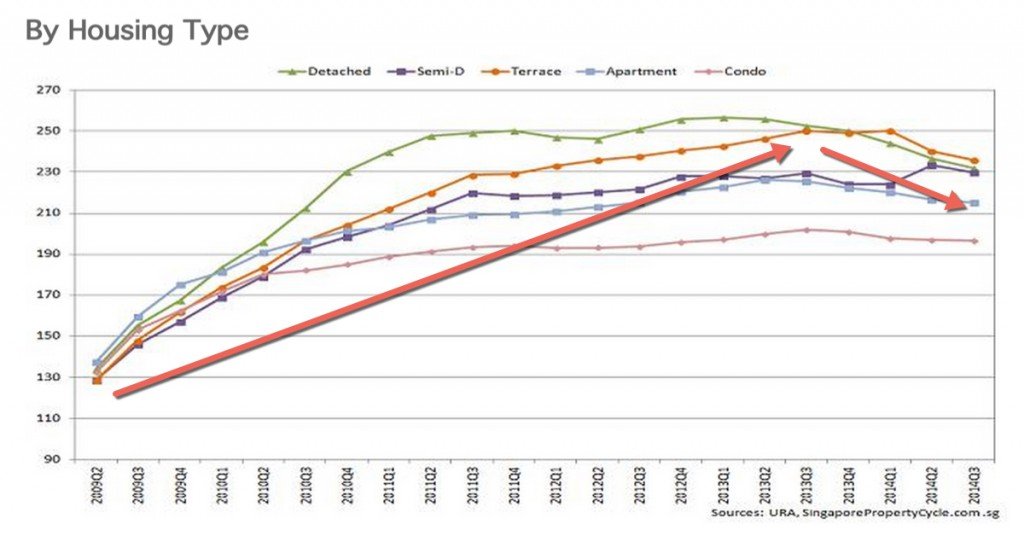

There has been a steady increase in property prices since around 2009, after the Financial Crisis in 2008. Why is this so?

In the past, rising property prices are mostly due to the increasing number of population in Singapore. According to the Department Statistics of Singapore, there is a whopping increase of 5 million population in 2009 to 5.4 million population in 2014 (9.7% increase)! There were more immigrants, new Permanent Residents and locals demanding for housing. In the process of building new homes, it requires long gestation period and time lag. The supply of flats could not keep up with the demand. When there is an excess demand, via market forces, prices naturally raise.

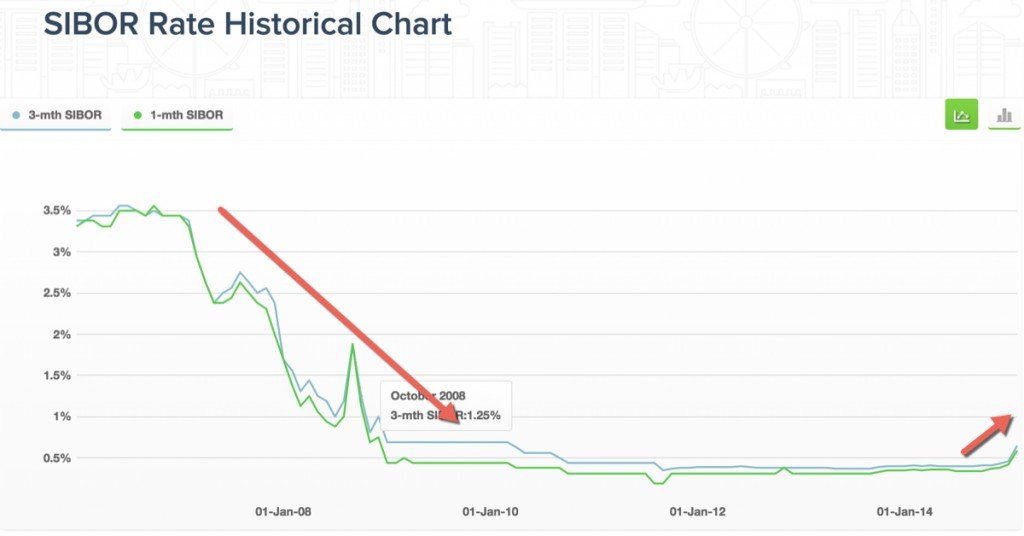

In addition, another important determinant of properties, interest rate has been very low since the financial crisis in 2008! Basically, expansionary monetary policies by Central Banks across the globe flush the world with excessive $$ and lowers interest rate to stimulate investments and consumption. SIBOR (also know as the Singapore Interbank Offering Rate) is the key benchmark of Singapore interest rates and is at record low!

With lower SIBOR hovering around 0.5% between 2009 till 2014, more and more Singaporeans are taking advantage of this phenomenon to take up loans from banks to buy properties, causing property prices to rise!

The combination of the determinants above led to a persistent increase in Singapore property prices from 2009 till 2013 Q4 (from index 130 in 2009 to index 240 in 2013). In short, there is a whopping 110% gain in price level between this period. Unbelievable!

In part 2 of the analysis, we will uncover the fall in prices of property starting 2014 using Demand and Supply in Singapore again! Stay tuned!

Note to JC students – we will be using fun and real life examples like these in our classes to bring learning JC Economics to life! We welcome you to participate in this fun and learning journey with us!

Author: Yong Ruixing (former graduate, batch of 2014)