Previously, we shared about the rising property price in Singapore from from 2008 till end of 2013 using economics theory : Demand and Supply and how is it applicable in Singapore. Today, we will be sharing about the plunging property prices using the same analogy!

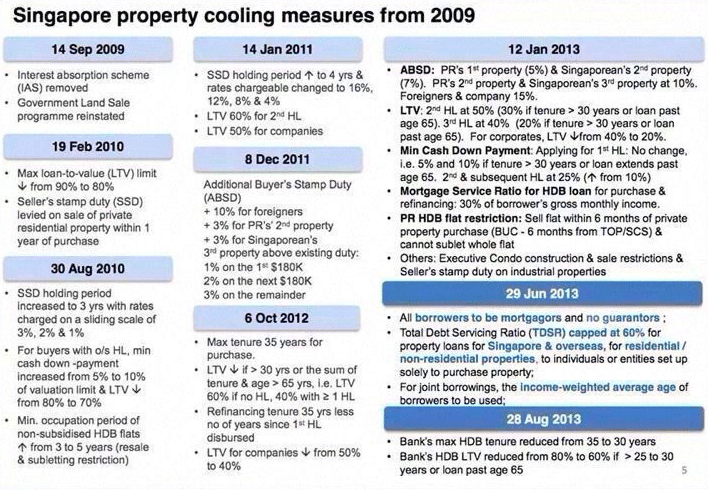

To deal with ever-rising property prices in 2008, Singapore Government had introduced several cooling measures, e.g. Additional Buyer Stamp Duties, Seller Stamp Duties and Total Debt Servcing Ratio (TDSR). So what are all these? In a nut shell, stamp duties are property taxes imposed on buying and selling of additional properties to curb speculative demand of properties while TDSR is imposed on all commercial banks to make lending money more stringent to speculate home buyers, also to curb speculative demand.

The responds to the cooling measures were deemed fast and obvious, concluding that those measures were largely successful. Or is it necessarily true?..

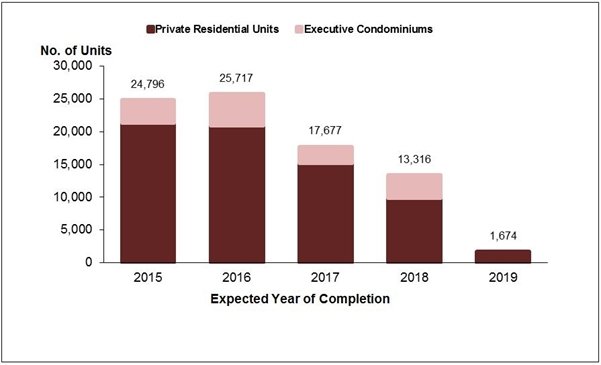

On the supply side, private developers have been busy building many more to catch up with the rising demand in the 2008 – 2013 period. With a typical building time of 3.5 years, will there be impending oversupply problem?

According to a latest URA report, during the fourth quarter of 2014, there were 308,814 completed private units on the market, up 2.1 percent from 302,510 units available in the previous quarter.

Of that number, there were 24,062 units which were vacant in the quarter or 11.6 percent higher than the 21,569 vacant units in the previous three-month period. Accompanied with MORE units coming into the market in 2015 and 2016, supply is expected to increase massively and the pressure on the property prices is expected to remain through 2017.

Accompanied with rising interest rates, which will further curb demand for properties due to higher borrowing cost, we expect the price of HDB / private residential properties (both asset classes are deemed to be good substitutes) and even commercial properties to remain subdued through 2015 – 2016 given an oversupply and subdued demand condition.

To all JC students: we will be plenty of interesting examples like this in our classes for discussion and illustration. If you are struggling with your JC economics, find out more how we can help you!

Author: Yong Ruixing (former graduate, batch of 2014)